Form 5498 documents individual retirement account (IRA) contributions, rollovers and distributions. You don’t need to fill it out or send it to the IRS — just keep it for your records.

Updated May 28, 2024 · 1 min read Written by Sam Taube Lead Writer Sam Taube

Lead Writer | Stocks, ETFs, economic news

Sam Taube writes about investing for NerdWallet. He has covered investing and financial news since earning his economics degree from the University of Maryland in 2016. Sam has previously written for Investopedia, Benzinga, Seeking Alpha, Wealth Daily and Investment U, and has worked as an editor for Investment U, Wealth Daily and Haven Investment Letter. He is based in Brooklyn, New York.

Assigning Editor Chris Davis

Assigning Editor | Cryptocurrency, brokerage accounts, stock market

Chris Davis is an assigning editor on the investing team. As a writer, he covered the stock market, investing strategies and investment accounts, and as a spokesperson, he appeared on NBC Bay Area and was quoted in Forbes, Apartment Therapy, Martha Stewart and Lifewire, among others. His work has appeared in The Associated Press, The Washington Post, MSN, Yahoo Finance, MarketWatch, Newsday and TheStreet. Previously, he was the content manager for the luxury property management service InvitedHome and the section editor for the legal and finance desk of international marketing agency Brafton. He spent nearly three years living abroad, first as a senior writer for the marketing agency Castleford in Auckland, NZ, and then as an English teacher in Spain. He is based in Longmont, Colorado.

Fact Checked

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeawaysIf you contribute to an individual retirement account (IRA) , there’s a tax form you should get familiar with — Form 5498. In simple terms, it’s a record of your IRA activities over the last year. Form 5498 is typically issued to anyone who has contributed to an IRA, but you generally won’t have to do anything with it once you receive it.

» Looking for retirement accounts? Check out our roundup of the best IRA accounts

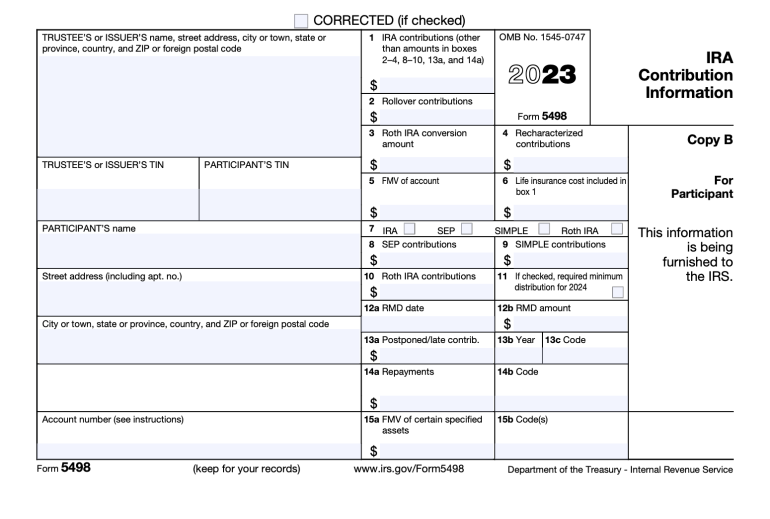

Form 5498 — formally called "Form 5498: IRA Contribution Information" — is a document that reports the fair market value of an IRA, along with any changes to that IRA, including contributions, required minimum distributions (RMDs), Roth IRA conversions and rollovers.

As an IRA holder, you are not required to file a Form 5498 with the IRS — your IRA custodian (e.g., Vanguard or Fidelity) is. You simply receive a copy for your own records.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees.Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax. File up to 2x faster than traditional options.* Get your refund, and get on with your life.*guaranteed by Column Tax

Anyone who owns an IRA should get a Form 5498 each year for each IRA they own. Form 5498 covers information related to traditional and Roth IRAs, SEP IRAs and SIMPLE IRAs .

Because it's possible to contribute to an IRA for the previous tax year until the mid-April tax filing deadline , IRA custodians typically have until May to file Forms 5498. For the 2023 tax year, the deadline for custodians to file Form 5498 is May 31, 2024, so it may arrive in your mailbox anytime between January and mid-June [0]

Internal Revenue Service . Instructions for Forms 1099-R and 5498 (2024). Accessed May 28, 2024.You don’t need to fill anything out on Form 5498, nor do you need to send it to the IRS — your IRA custodian has already done that for you. Form 5498 is provided to you purely on a “for your information” basis.

That said, like any tax form, it’s worth keeping any Form 5498s you receive in a safe place for several reasons:

It’s good to keep tax forms in case of an audit . In particular, maintain a paper trail for big deductions such as traditional IRA contributions . If, for whatever reason, the IRS questions traditional IRA contributions you deducted in years past, Form 5498 can serve as third-party documentation of those contributions.

Form 5498 may be helpful for properly reporting your IRA contributions on your Form 1040 (individual income tax return). Traditional IRA contributions are an important deduction for many taxpayers, and Form 5498 shows you the amount of traditional contributions that the IRS is expecting you to report for a specific account and tax year. Using it can help you avoid mistakes when adding up the total amount of IRA contributions you can deduct.

Box 3 of Form 5498 can help you stay on top of tax liability from a Roth IRA conversion. If you previously contributed money to a traditional IRA, deducted those contributions, and then converted that traditional IRA to a Roth IRA , you now owe taxes on that money. The “Roth IRA Conversion Amount” box of Form 5498 can help you fill out Form 8606 ( Nondeductible IRAs ), which tells you how much taxable income your Roth IRA conversion generated.

» Curious about Roth accounts? Shop for some of the best Roth IRA accounts

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

About the authorYou’re following Sam Taube

Visit your My NerdWallet Settings page to see all the writers you're following.

Sam Taube writes about investing for NerdWallet. He has covered investing and financial news since earning his economics degree in 2016. See full bio.

On a similar note.

View NerdWallet's picks for Roth IRAs.

See the list

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105